As an accounts expert, I often find myself delving into the intricate details of financial planning and risk management. Today, I’d like to shed some light on a lesser-known but incredibly important aspect of car insurance: gap insurance. This specialized coverage can play a crucial role in protecting your financial interests, particularly in certain situations where traditional insurance coverage may fall short.

Understanding Gap Insurance

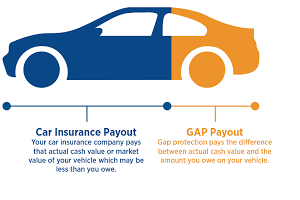

First, let’s clarify what exactly gap insurance is and how it differs from standard car insurance policies. Gap insurance, short for Guaranteed Asset Protection, is a type of insurance coverage that fills the gap between the amount you owe on your car loan or lease and the actual cash value of your vehicle in the event of a total loss. This “gap” arises because the value of a vehicle depreciates over time, often faster than the loan balance decreases.

When Might You Need Gap Insurance?

Now, let’s explore the scenarios in which gap insurance becomes particularly valuable:

1. Leasing or Financing a New Vehicle:

If you’ve recently financed or leased a new vehicle, chances are you owe more on the loan or lease than the car is worth due to depreciation. In the unfortunate event of a total loss—such as theft or severe accident—your standard insurance coverage may only reimburse you for the actual cash value of the vehicle, leaving you responsible for paying off the remaining balance on the loan or lease out of pocket. Gap insurance steps in to cover this shortfall, ensuring you’re not left with a hefty financial burden.

2. High-Risk Drivers:

If you’re considered a high-risk driver due to factors such as age, driving history, or credit score, you may face higher insurance premiums. In the event of an accident resulting in a total loss, your insurance payout might not be sufficient to cover the outstanding loan balance. Gap insurance provides an extra layer of protection, shielding you from potential financial strain.

3. Depreciation Rates:

Certain vehicles, particularly luxury cars or models with high depreciation rates, are more susceptible to significant value decreases over time. In these cases, the gap between the loan balance and the vehicle’s value widens rapidly, making gap insurance a wise investment to safeguard your financial interests.

Conclusion: Protecting Your Financial Future

In conclusion, gap insurance serves as a crucial safety net for individuals who find themselves in situations where the outstanding loan or lease balance on their vehicle exceeds its actual cash value. By filling this gap, gap insurance ensures that you’re not left financially vulnerable in the event of a total loss. As an accounts expert, I highly recommend considering gap insurance when leasing or financing a new vehicle, particularly if you fall into any of the aforementioned risk categories or if your vehicle is prone to rapid depreciation. Ultimately, investing in gap insurance can provide peace of mind and protect your financial future.